blog

Unlocking Yield and Stability: Asset Based Finance in Modern Wealth Portfolios

David Vatchev

27 August 2025

Why Alternatives Matter

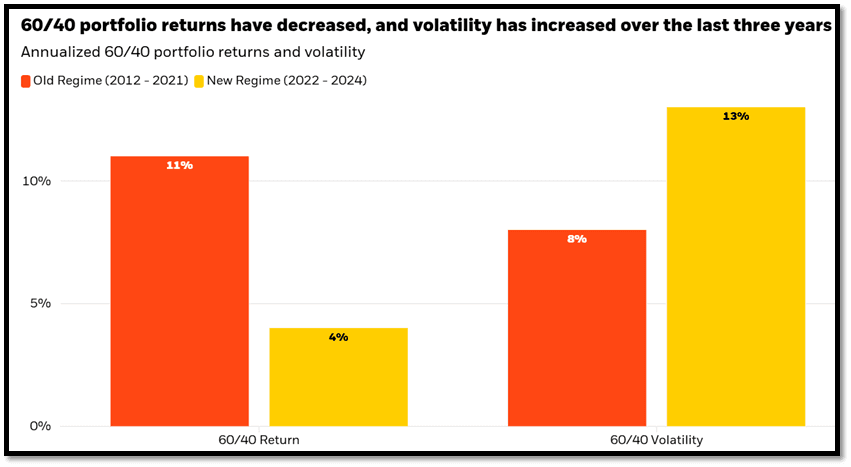

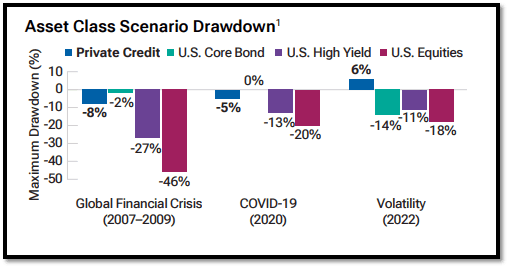

Traditional 60/40 portfolios have struggled in today’s environment of inflation, rate hikes, and volatility. Bonds and equities now frequently move in sync, reducing their historical diversification value:

Source: Blackrock March 2025, Morningstar, returns and volatility as of 12/31/2024. Volatility is measured by the standard deviation of monthly returns over the period. 60/40 portfolio is represented by a 60% allocation to the S&P 500 Index and a 40% allocation to the Bloomberg US Aggregate Bond Index. • Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one can not invest directly in an index. Past performance does not guarantee future results.

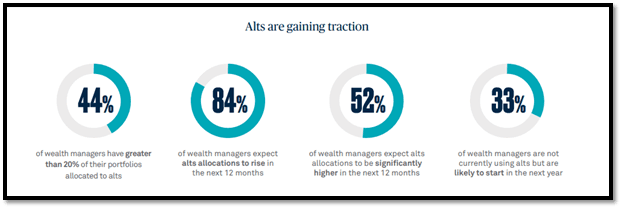

At Fasanara Capital, we previously explored strategies to future proof traditional 60/40 portfolios, and now advisors are increasingly turning to alternatives to restore portfolio balance and yield. According to a recent survey, 84% of wealth managers plan to increase allocations to alternatives specifically to diversify portfolios and boost returns:

Source: BNY Mellon, 2024

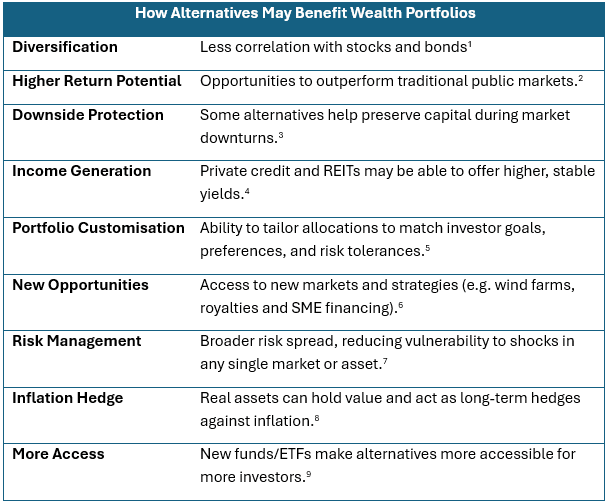

Traditional portfolios have been tested by recent economic volatility, inflationary pressures, and evolving regulations. Core bonds have at times failed to hedge equity risk, and equities themselves have experienced sharp swings, eroding the reliability of the old models. This has highlighted the need for assets with different performance drivers. Alternatives like private equity, real estate, infrastructure, hedge funds, and private credit may be able to:

- Lower volatility

- Increase yield

- Offer portfolio customization

- Provide exposure to different risk/return drivers

It should, however, be noted that alternative investments are complex, may be illiquid and carry a risk of capital loss. They may not be suitable for all investors.

As a result, allocating a portion of portfolios to alternatives has become increasingly important for achieving long-term stability and risk-adjusted returns in a changing market environment. Here’s what alternatives can potentially offer:

Sources: 1Pimco, 2Brookfield, 3BoA, 4Morgan Stanley, 5CAIS, 6Pimco, 7TitanWCI,8JPM Asset Management, 9RBC Wealth

In short, alternatives may help diversify portfolios and offer different sources of return that a modern wealth portfolio needs when stocks and bonds alone disappoint.

The Rise of Private Credit: Filling the Financing Gap

Within the alternative asset universe, private credit has emerged as a particularly attractive segment. In the aftermath of the Global Financial Crisis, banks have scaled back lending, especially to mid-sized companies and niche sectors, due to stricter capital regulations (think Basel III/IV) that make certain loans less attractive for banks. The retreat by traditional banks has created a significant financing gap, swiftly being filled by flexible, specialised private credit lenders. For example, in Europe alone, bank lending has declined by an estimated $2 trillion since the financial crisis, leaving many small and medium-sized enterprises (SMEs) starved for credit (iCapital)

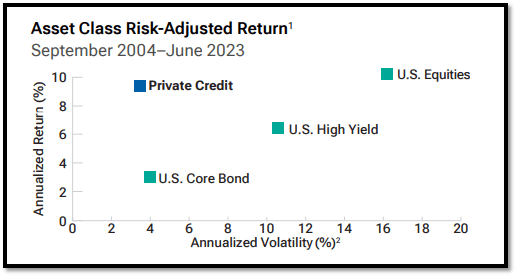

Source: T.Rowe Price 2023, Note: returns are not guaranteed and investment in private credit may be illiquid and subject to default risk

Due to its risk/return profile, combined with structural protections (covenants, senior collateral claims), wealth investors may consider private credit for income generation.

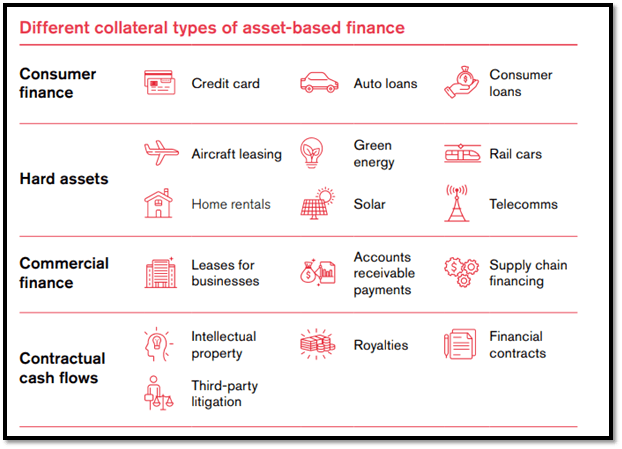

Asset-Based Finance: A Specific Opportunity in Private Credit

The Asset-Based Finance (ABF) exceeds over $20 trillion globally (Pimco) and involves lending secured explicitly by tangible or financial assets, relying on predictable cash flows and collateral rather than unsecured corporate risk. In contrast to an unsecured corporate loan (where repayment depends on the borrower’s enterprise value and cash flow), ABF lenders underwrite against the cash flow profile of discrete pools of assets. The assets can range widely, from consumer and small business loans to leases on equipment or property, to receivables from trade or credit card payments. Because repayment comes from the assets themselves (often via borrowers’ payments into a structured vehicle), ABF is less reliant on a single company’s fortunes and benefits from collateral that can be collected or sold if needed.

Key Categories of ABF

Financial Assets:

Credit that is backed by financial receivables or contracts. This category includes things like credit card receivables, consumer loans, residential mortgages, student loans, and small business loans. These portfolios are typically highly granular, containing thousands of individual obligations with predictable payment streams.

Hard Assets:

Financing backed by physical or tangible assets and their associated cash flows. Examples include equipment loans and leases (for machinery, trucks, aircraft, etc.), transportation assets (shipping containers, railcars, airplanes). These tend to be essential use assets critical to a business’s operations, which ensures reliable economic value.

Source: Macfarlanes, January 2025

Here are a few real-world examples of asset-based finance strategies that aim to deliver yield with safety:

- European SME Invoice Financing: Wealth managers can fund portfolios of short-term invoices issued by small businesses. For example, a manufacturer sells its accounts receivable (due from a creditworthy buyer) to get instant cash flow, and the financier (the fund) earns the fee/interest when the invoice is paid.

- Trade Receivables from Large Corporates: For instance, financing a shipment of goods where a multinational buyer has committed to pay on delivery. Such deals are self-liquidating (repaid by the shipment proceeds) and collateralized by either the goods or the receivable from the strong corporate buyer.

- Consumer Credit Portfolios: A fund might buy a portfolio of credit card receivables originated via fintech platforms or bank partnerships. These are granular pools with thousands of borrowers, yielding a diversified stream of interest payments.

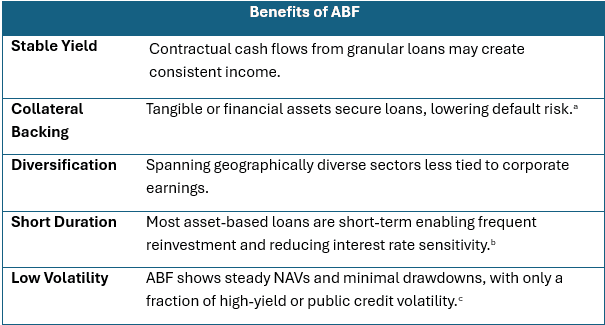

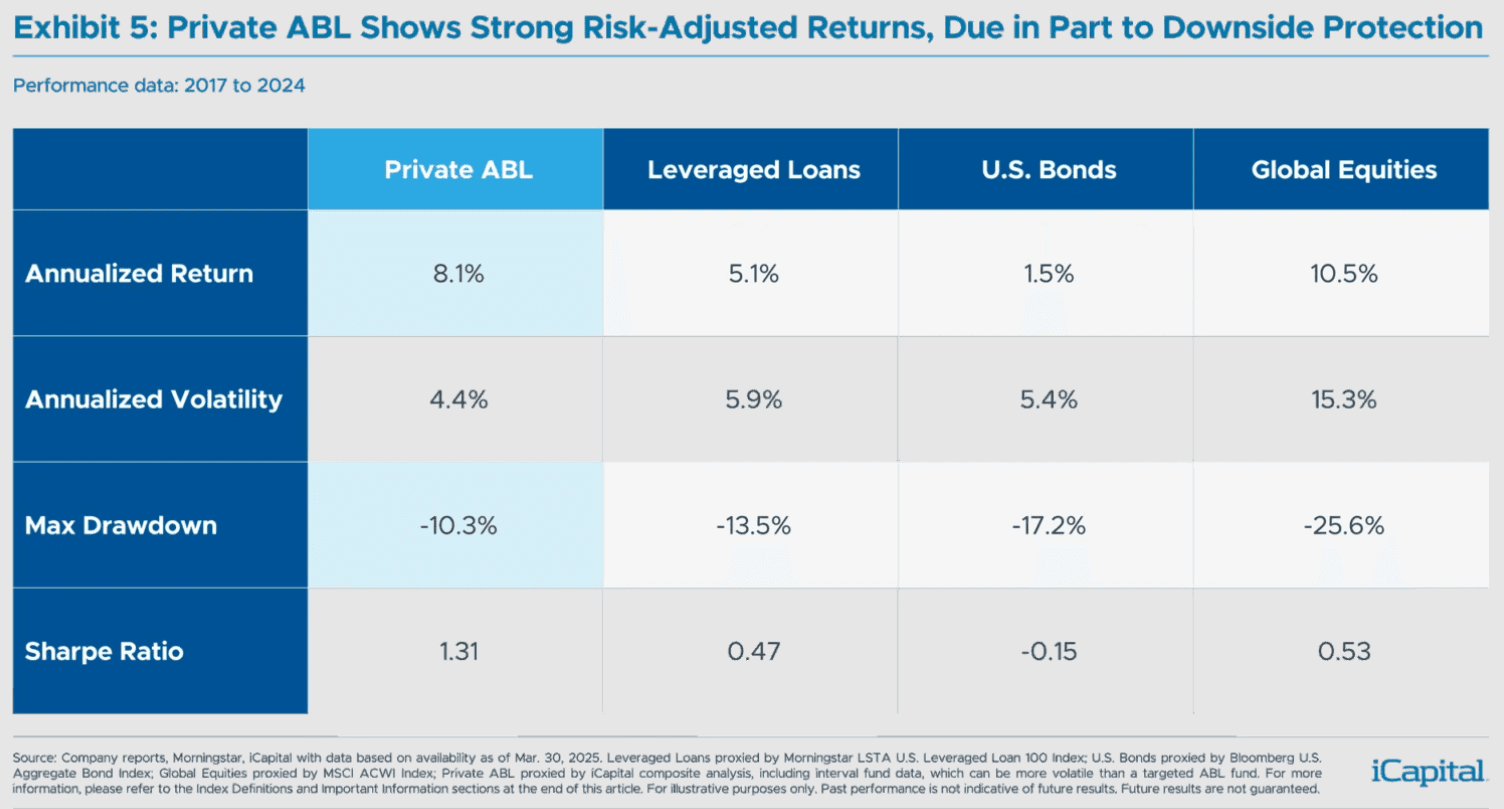

ABF’s collateralized nature can potentially offer lower volatility and stronger downside protection, even in stressed markets, given loans are secured by high-quality, short-duration assets.

For wealth advisors, ABF stands out given the potential combination of consistent yield and minimal volatility. Correlation to public markets has been low at times yet can rise. The strategy seeks credit alpha from underwriting and structuring rather than market beta.

The Benefits of ABF for Wealth Portfolios

ABF offers a compelling set of benefits for high-net-worth portfolios, especially in today’s volatile macro environment.

Source: aTCW, bAXA Investment Management, ciCapital

Source: iCapital, May 2025

Building ABF Into a Wealth Portfolio

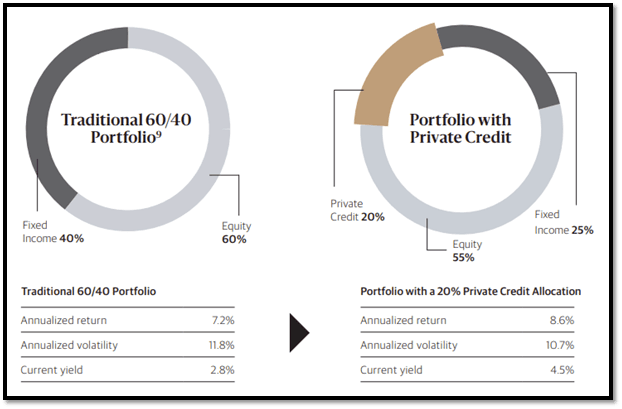

By adding a reasonable private credit allocation to a traditional 60/40 stock and bond portfolio, investors could potentially offset the introduced illiquidity risk, with an increase in the return potential of the portfolio, while simultaneously reducing the volatility:

Source: Blackstone. Note that the benefits of including a private credit allocation into a portfolio are not guaranteed.

So, how can RIAs, family offices, and private banks practically integrate ABF into client portfolios?

(1) Manager Selection: Given the specialized nature of ABF, selecting experienced managers is paramount. Underwriting asset-based deals requires niche expertise in collateral valuation, legal recovery, and servicing operations. Seek specialist firms with proven track records in ABF sub-sectors such as trade finance, consumer credit, or equipment leasing. High-quality managers often leverage proprietary technology or fintech partnerships (e.g., invoice financing platforms) for sourcing and deploy robust risk management frameworks. Look for consistent historical performance, low net loss ratios, and strong operational capabilities across origination, servicing, and recovery and take care to note, there is no guarantee that historical outcomes will be repeated.

(2) Access Vehicles: ABF can be accessed through a range of vehicles based on client liquidity needs and investment horizons. Options include:

- Dedicated ABF funds typically structured as private credit or interval funds with periodic liquidity.

- Multi-strategy private credit funds where ABF is one sleeve alongside corporate or real estate lending—offering built-in diversification.

- Feeder funds, SMAs, and emerging tokenized/digital wrappers that enable fractionalized access and smaller minimums into diversified pools of asset-based loans.

(3) Portfolio Fit:

- ABF can play a defensive, income-oriented role within fixed income or alternative credit allocations for professional clients. Some advisers use it as a “credit anchor” to support distribution targets via contractual cash flows, recognising that payments and valuations can be affected by borrower performance, defaults, recoveries and liquidity constraints. Relative to long-duration bonds, many ABF strategies exhibit lower interest-rate sensitivity, but remain exposed to credit, structural and servicing risks. In multi-asset portfolios, ABF may help dampen equity-led volatility, although correlations can rise in stressed markets. Strategically, ABF can:

- Replace part of traditional bond holdings to pursue higher income with typically lower duration; still subject to credit spread.

- Complement equity allocations as a potential stabiliser in drawdowns.

- Use selectively for liquidity needs where appropriate.

(4) Liquidity Planning: ABF allocations should be aligned with the client’s liquidity profile and planning horizon. Understand the liquidity terms of the underlying fund (ie quarterly redemptions, semi-liquid vehicles, or fully locked structures) and match them to the investor’s goals. For cash-flow-driven portfolios, ensure that capital deployment timelines and repayment schedules are clearly mapped. Advisors can also ladder ABF exposure across vintages or maturities to smooth distributions and reinvestment.

Conclusion: A Core Defensive Credit Allocation

By embedding ABF within the portfolio’s credit sleeve, advisors may be able to enhance stability without sacrificing returns and potentially align directly with the core objectives of sophisticated HNW investors:

- Preserve capital

- Generate income

- Avoid big drawdowns

ABF could potentially be a foundational building block for modern portfolios seeking stable, risk-adjusted yield.

Disclaimer

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell, or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investors or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with their financial professionals. The views and opinions expressed are for informational and educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition. Any changes to assumptions that may have been made in preparing this material could have a material impact on the information presented herein by way of example. Past performance does not predict or guarantee future results. Investing involves risk; principal loss is possible. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Fasanara Capital Ltd, is authorised and regulated by the Financial Conduct Authority (“FCA”).

Important information on risk

Investing involves risk. The value of any investment and the income from such can go down as well as up, and you may not get back the full amount invested. Past performance is not a guarantee of future returns. Changes in the rate of exchange may also cause the value of overseas investments to go up or down. This information represents the views of Fasanara Capital Ltd and its investment specialists. It is not intended to be a forecast of future events and/or guarantee of any future result. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. There is no assurance that an investment will provide positive performance over any period of time. This information does not constitute investment research as defined under MiFID.